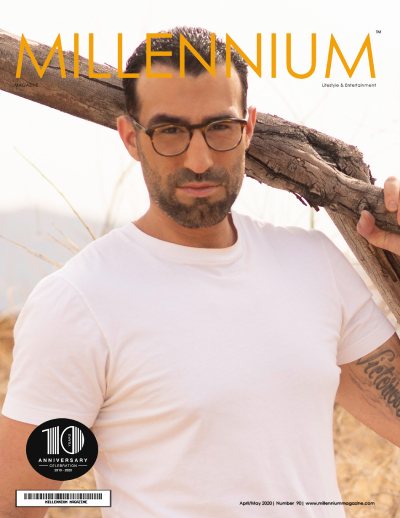

Australian-born and Los Angeles-based Jeremy Kasler credits his success in tangible asset diversification to painting a broad canvas for his enterprises over the past two decades in specialty finance, alternative asset investment, and corporate strategy. And while investments in fine wine have been fermenting for generations, he’s thinking outside of the bottle as the CEO of CaskX, a company he founded in 2019 that infuses his personal love for whiskey with his extensive expertise in pioneering innovative new investment platforms…and not only for the most elite connoisseurs.

Australian-born and Los Angeles-based Jeremy Kasler credits his success in tangible asset diversification to painting a broad canvas for his enterprises over the past two decades in specialty finance, alternative asset investment, and corporate strategy. And while investments in fine wine have been fermenting for generations, he’s thinking outside of the bottle as the CEO of CaskX, a company he founded in 2019 that infuses his personal love for whiskey with his extensive expertise in pioneering innovative new investment platforms…and not only for the most elite connoisseurs.

“I launched CaskX with the goal of bridging the gap between distilleries and investors to bring the financial benefits of whiskey investment to the global stage,” explains Kasler from his Los Angeles headquarters. “At the same time, we aim to help our top market distilleries withstand the cash flow pressures that are inherent with whiskey production. Things have moved fast since we launched, as we’re now serving investors and distilleries through offices in Sydney, Los Angeles, and Hong Kong. By offering unparalleled transparency and advanced technology, we’re ushering in a new era of investment into the whiskey industry through our unique business model.

Kasler brings to all of his endeavors 22 years of experience in international marketing within the property and investment sector. His wealth of experience and his lifelong passion for fine art imbued him with the ability to be a driving force behind the setup and subsequent success of Art Futures Group, which he founded in 2010 and in 2019 sold to Hong Kong-based Macey and Sons in an all-cash buyout. The organization grew to be one of the world’s largest art investment brokers, thanks to his leadership as CEO leading the company’s strategic growth and directing the standard of excellence that defined all company operations.

“We were the first in Asia to pioneer a complete end-to-end art investment service devoted to bringing art investment from the high-cost playing field of the elite to middle-class working professionals and Gen Y investors,” he notes, drawing parallels to CaskX’s business model. “By connecting artists directly with purchasers through its innovative commercial platform, AFG empowered purchasers to bypass the traditional middlemen of galleries, museums, and exhibition halls, and bring the investing in the art world to a much broader sphere.”

Although luxury goods have been evolving into forms of commodity, Kasler hopes to make investing in spirits approachable and explain how they are investments beyond one’s personal bar and desire to make a good impression when entertaining at home and at work. He also reflects on expanding his reach by setting up a home base in the Western United States.

Millennium: What are some of the interesting parallels between art investment and fine spirits investing?

Jeremy Kasler: Both can be considered passion investments to some extent. People love the idea of investing in and making money from a product they personally enjoy. Parallels can be drawn between that and being lucky enough to work within an industry you love.

Millennium: When you decided to develop this unique business, what were the factors that prompted you to choose Beverly Hills as your U.S. base (over places like New York) and live in the US permanently?

Jeremy Kasler: There were a number of factors we considered, especially the U.S. time zone. We can now start early in the morning communicating with our clients and potential clients in the South and on the East Coast. We then tend to speak with our West Coast clients later in the day. Having an early start allows us to finish at 4 pm and hopefully make time to enjoy the beautiful California beaches and lifestyle.

It’s also prestigious to reside in Beverly Hills, which is well-known and recognized as one of the world’s premium locations.

Millennium: How did the business model come together, and how did you address concerns about how spirits investment could be profitable and the logic of investing in spirits beyond their personal use?

Jeremy Kasler: As the first company in the U.S. to offer whiskey barrels for investment, we have faced many challenges along the way. Most of these were related to the SEC and legal compliance. Of course, as the leaders of offering a new U.S. investment opportunity, the benefits and returns for our clients are proving great. The bourbon market itself is booming in the U.S., and all we have done is present an opportunity to the retail investor who has been available to whiskey industry insiders for many generations.

Millennium: Describe the process of vetting a distillery and the quality of its product before selecting it as a commodity, as well as vetting different whiskeys and bourbons.

Jeremy Kasler: The first thing we establish is: Does the distillery have a good track record? We do intensive due diligence looking at market feedback, popular opinion, taste, etc. Next, we have to establish if they can produce a consistent amount for our investors. We then have our Director of Whiskey, Sara Havens, go to the distillery for a site visit and to personally taste the bourbons and whiskeys they produce. If all the boxes are ticked, we move forward and attempt to negotiate a favorable price for ourselves and, therefore, our clients.

Millennium: How did your past career(s) prepare you for not only going the entrepreneurial route but also going into ultra-luxury categories that are often regarded as risky?

Jeremy Kasler: I started from a reasonably humble background. But one thing my parents and grandparents always instilled in me was that I was everyone’s equal. I should always aim high and always demand the best from everyone and everything. It’s OK to aspire to the best products, as my father always said, “Someone’s going to buy it, why not you?”

My parents also instilled in me a sense of adventure and an entrepreneurial spirit that thrives to this day. As a natural salesman, I’m drawn toward the ultra-luxury market for its quality of products and wide array of informed clients.

Millennium: What are some basic guidelines you share with clients on investing in spirits? What should they base their decisions on, and is there a reference book or document they can consult when making decisions on what to invest in?

Jeremy Kasler: Since this is a relatively new market in the U.S., there are no books yet on the guidelines or right ways to invest. Maybe I’ll write about it at some point. In the meantime, you can look to the scotch whisky market as a pointer. Retail investors have been profiting from that market for 20+ years now. There are countless websites giving advice on how to invest successfully in the scotch market, and the same thoughts can be applied to bourbon.

Here are some of my rules of thumb:

- Always deal with a reputable company before parting with funds. Like any industry, some companies are more reliable than others.

- Don’t enter the market unless you are prepared for a medium- to long-term investment cycle. We would always suggest a minimum hold of at least four years, longer if possible.

- Don’t put all your eggs in one basket. Some distilleries will perform better than others, so we would suggest a spread of at least five distilleries.

Millennium: How does being a spirits investor transcend buying spirits as a hobby? How do purchasing decisions differ?

Jeremy Kasler: They are chalk and cheese. You would generally only buy spirits you enjoy. The investment potential has nothing to do with your buying choice. With investment, it’s all about returns — whether you enjoy the spirit or not has no bearing on your decision.

Millennium: What are some of the most important lessons you’ve learned from your clients, either on the art end or spirits investment end?

Jeremy Kasler: I’ve learned to not be tempted to trade too quickly. I’ve known clients in the art world who could have multiplied their returns with a little more patience. Whiskey and art are not like day trading or the crypto market. In order to maximize your profits, you should be prepared to sit and wait. The upside to that is you are holding a tangible product that rarely goes down in value.

Millennium: How do the investing and connoisseur markets differ between here and in Australia?

Jeremy Kasler: They are very similar in most aspects. The obvious difference is that the U.S. is a much, much bigger market and therefore the liquidity tends to be better.